We have all the convenience you need. Manage your MACU accounts from anywhere, 24/7.

- Free – Access to your account anytime, anywhere with no hidden charges or fees.

- Secure – Two-factor authentication and up to date security technology ensure your banking information is safe and secure.

- Easy-to-use – Our modern digital banking platform is a user-friendly platform for at home or on the go.1

Visit our FAQ page for more details on how to use specific digital features.}

A convenient way to pay straight from your phone! Upload your debit and credit card to your favorite mobile wallet and never have to worry about forgetting your wallet again. Mobile wallet is secure and encrypted for safer shopping. Check out our mobile wallet options and handy tutorials to start using your mobile wallet.

Get started: Load your debit and credit card into your preferred mobile wallet.

- Apple Pay - wallet upload directions by Apple

- Samsung Pay - wallet upload directions by Samsung

- Google Pay - wallet upload directions by Google

Interested in more in-depth information about mobile wallet. We've got you covered. Check out our mobile wallet blog post.

Our Credit Scoring Tool, powered by SavvyMoney, is a free service to give you access to your full credit report, provide credit monitoring alerts, simulate ways to improve your score, and help you discover savings for new and existing loans.

DETAILS 3 Details NameDetails ContentParagraphTo open the popup, press Shift+EnterTo open the popup, press Shift+Enter Details Content is required. Delete

How do I get this Credit Scoring Tool?

You have free access through online and mobile banking.

For a more indepth overview of different features and how to use this tool, visit our FAQ page.

Note: The credit score displayed is the primary's credit score. The Credit Scoring Tool will not show any joint account holder's credit score. This credit scoring tool is only available for personal accounts. Business and non-individual accounts will see the credit score tool tile, but will not be able to see their credit score. Business and non-individual accounts may still view special offers.

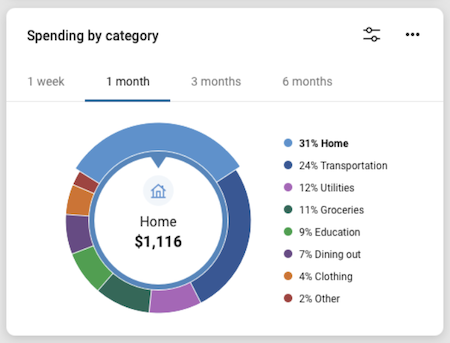

Organize your transactions to better understand your spending with spending categories. Many common retailers will be categorized automatically with the name and logo of the retailer, or you can pick one that fits the transaction best.

To edit a transactions category, click on the transaction and select Edit Details. You can select a category and name the transaction.

The Spending by category dashboard is available in online banking and can give you a visual of your spending over a given time frame. Enjoy the ability to check your budget at a glance.

Pay anyone, anywhere right from your computer or mobile phone. There is no limit to the number of bills you can pay.

- Pay one-time or recurring bills with ease:

- Schedule payments in advance

- Set up payment reminders

- Ensure payments are received on time

- Have all payee information in one convenient place

- Retain funds until paper drafts are presented for payment

- Avoid paper clutter

- More secure than paper billing

- Save time with fewer branch trips

- Pay your bills online via Alexa

- $5 monthly fee (may be waived with MyCashback Checking when account requirements are met)

Securely send a message directly to our MembersAlliance support. Send a specific transaction, an account, or attach a picture of a receipt for greater ease of communication.

Get in-app, email, or text notifications for:

- Low balance

- Large transactions

- Changes in email, phone number, or password

For Debit or Credit Card specific alerts check out Purchase Alerts.

Enjoy easy, early access to your statements with eStatements. When your newest statement is ready, you will receive an email notice that it has been posted to your digital banking. Up to 36 months worth of past statements are readily available.

Less paper, less mess, less stress. Why not enroll in eStatements today? To enroll, click the view eStatements tile on your digital banking dashboard. Then, select all accounts and click enroll.

Have more questions about eStatements? Visit our Digital Banking FAQ page.

Deposit your checks anytime, anywhere. Mobile deposit is available through the mobile app for qualified accounts.

Note: Make sure you sign and write "MACU - For mobile deposit only" on the back of the check.

Card Management for digital banking allows you to:

- Activate your new card.

- Block and unblock your debit card.

- Report your card lost or stolen.

- Add a travel notice to your debit cards.

Learn & Earn is an educational incentive program geared to equip our members with personal finance lessons.

This program offers a wide variety of courses that offer fun and interactive learning. Along with the learning is reward earning. From loan discounts to amazon e-gift cards, there is something for everyone.

Check out our cyber safety course and reward below.

Cyber safety course ($5 amazon e-gift card)

The world wide web can be a hazardous place when it comes to personal information. Protecting your banking and personal information is vital. Learn how to avoid scams and use digital tools with this fun course.

How do I get my reward?

- Must be 18 or older

- Must have an account at MembersAlliance

- Complete all course material in this section

Once completed, a MembersAlliance employee will verify membership and send the e-gift card to your email account within seven business days.

Rewards disclaimer: Members must be in good standing and are eligible to receive each available incentive one time per member only. Members must meet each tutorial’s requirements to receive the corresponding incentive. Incentive eligibility and payout is subject to review and approval by MembersAlliance Credit Union. Loan discounts and closing costs available on approved loans. Loans subject to credit approval. Some restrictions may apply. MembersAlliance employees are not eligible. Individual incentives may be rejected if MembersAlliance determines the individual does not qualify for redemption or attempts to subvert the intended nature of the program for personal gain.

1WiFi access or 3G or higher network is required. Mobile service provider download and usage charges may apply. See your service provider's terms and conditions.

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Autos, Trucks and Motorcycles

2026 - 2025

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 4.00% | $29.52 |

| 37-78 Months | 5.00% | $29.22 - $15.04 |

| 79-84 Months | 6.00% | $15.35 - $14.61 |

| 85-96 Months / $40,000 Min. | 7.000% | $14.96 - $13.63 |

2024 - 2021

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 5.50% | $30.20 |

| 37-78 Months | 5.50% | $29.45 - $15.28 |

| 79-84 Months | 6.50% | $15.59 - $14.85 |

2020 - 2018

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 5.50% | $30.20 |

| 37-78 Months | 5.50% | $29.45 - $15.28 |

| 79-84 Months | 6.75% | $15.71 - $14.97 |

2017 and older

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 24 Months | 7.50% | $45.00 |

| 25-36 Months | 7.50% | $43.33 - $31.11 |

| 37-48 Months | 7.75% | $30.47 - $24.30 |

| 49-60 Months / $20,000 Min. | 8.50% | $24.23 - $20.52 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

Computer and Other Durable Goods

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 24 Months | 7.00% | $44.79 |

| 36 Months | 8.00% | $31.35 |

| 48 Months | 9.00% | $24.90 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

FastCash Loan

| Loan Type/Term | Rate (as low as) | Pmt/$1,000 |

|---|---|---|

| Up to 12 Months | 9.50% | $87.68 |

| 13-24 Months | 9.75% | $81.37 - $46.03 |

| 25-36 Months | 10.00% | $44.48 - $32.27 |

| 37-48 Months | 10.50% | $31.75 - $25.61 |

| 49-60 Months | 11.25% | $25.55 - $21.87 |

| Signature Line of Credit | 10.90% | 3% of Limit |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit). Not available on Unsecured Line of Credit Loans.

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

Home Equity - Fixed Rate - Up to 80% Loan to Value

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| Up to 60 Months | 6.00% | $44.32 - $19.34 |

| 61-120 Months | 6.75% | $19.42 - $11.49 |

| 121-180 Months | 7.25% | $11.68 - $9.14 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Monthly Payment Installment samples shown are based on every $1,000 borrowed. Rates may vary based on credit evaluation. Rates subject to change without notice. Closing costs may vary if out of the Rockford area, an appraisal is required, or a release of mortgage is recorded.

Home Equity Line of Credit - Adjustable Rate - Up to 80% Loan to Value

Rate discounted at 6.625% for the first year. Adjusts to the Wall Street Journal Prime Rate annually, which is currently at 6.750% Maximum APR = 18% Annual Fee = $10.00

Monthly Payment Installment samples shown are based on every $1,000 borrowed. Rates may vary based on credit evaluation. Rates subject to change without notice. Closing costs may vary if out of the Rockford area, an appraisal is required, or a release of mortgage is recorded.

IRA/CD Rates

| Type/Term | Minimum Opening Deposit | Rate | APY | Penalty for Early Withdrawal |

|---|---|---|---|---|

| Base IRA (Primary, Education, Roth) | $500 | 0.150% | 0.150% | N/A |

| 3 Month CD* | $500 | 0.995% | 1.000% | 90 Days* |

| 6 Month CD/IRA CD** | $500 | 1.980% | 2.000% | 90 Days |

| 9 Month CD/IRA CD | $500 | 2.250% | 2.275% | 90 Days |

| 12 Month CD/IRA CD | $500 | 2.956% | 3.000% | 180 Days |

| 18 Month CD/IRA CD | $500 | 2.956% | 3.000% | 180 Days |

| 24 Month CD/IRA CD | $500 | 2.762% | 2.800% | 180 Days |

| 30 Month CD/IRA CD | $500 | 2.762% | 2.800% | 180 Days |

| 36 Month CD/IRA CD | $500 | 2.762% | 2.800% | 180 Days |

| 48 Month CD/IRA CD | $500 | 1.980% | 2.000% | 365 Days |

| 60 Month CD/IRA CD | $500 | 1.980% | 2.000% | 365 Days |

Minimum Deposit = $500.00. A penalty will or may be imposed for early withdrawals. *3 month CD not eligible for IRAs.** 6 month CD not eligible for Roth and Education IRAs.

Money Market Accounts

| Balance | Rate | APY |

|---|---|---|

| $2,500 - $9,999.99 | 0.946% | 0.950% |

| $10,000 - $24,999.99 | 1.094% | 1.100% |

| $25,000 - $99,999.99 | 1.341% | 1.350% |

| $100,000+ | 1.587% | 1.600% |

Off Road RVs, Snowmobiles and Jet Skis

2026 - 2025

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 4.50% | $29.75 |

| 37-48 Months | 6.25% | $29.78 - $15.63 |

| 49-80 Months | 6.75% | $15.71 - $14.97 |

| 61-78 Months / $20,000 Min. | 7.25% | $15,08 - $13.76 |

2024 - 2018

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 5.50% | $30.20 |

| 37 -48 Months | 6.50% | $29.90- $15.75 |

| 49-60 Months | 7.50% | $16.08 - $15.34 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

Personal Loans (Unsecured)

| Loan Type/Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| Up to 12 Months | 9.50% | $87.68 |

| 13-24 Months | 9.75% | $81.37 - $46.03 |

| 25-36 Months | 10.00% | $44.48 - $32.27 |

| 37-48 Months | 10.50% | $31.75 - $25.61 |

| 49-60 Months | 11.25% | $25.55 - $21.87 |

| Signature Line of Credit | 10.90% | 3% of Limit |

| FastCash* | 23.00% | $177.96 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit). Not available on Unsecured Line of Credit Loans.

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

*FastCash Application fee of $20 required, regardless of approval decision. FastCash loan is a fixed rate of 23%APR on loan amounts from $200 to $1,000 with terms not to exceed 6 months. Financing example: The monthly installment repayment for $1,000 financed for 6 months at 23.00% is $177.96. No credit check. MACU membership must be at least 90 days old and have an existing direct deposit with the credit union. Only one FastCash loan per household. Some restrictions may apply.

Primary Mortgage

Conventional Mortgages - 5% Down

| Term | Points | Rate (as low as) | Pmt/$10,000 | APR |

|---|---|---|---|---|

| 15 Year Fixed Rate | 0.000 | 4.990% | $79.03 | 5.215% |

| 15 Year Fixed Rate | 1.000 | 4.500% | $76.50 | 4.862% |

| 20 Year Fixed Rate | 0.000 | 5.625% | $69.50 | 5.988% |

| 20 Year Fixed Rate | 1.000 | 5.375% | $68.08 | 5.695% |

| 30 Year Fixed Rate | 0.000 | 5.750% | $58.36 | 6.129% |

| 30 Year Fixed Rate | 1.000 | 5.500% | $56.78 | 5.948% |

| 5/6 Year ARM | 0.000 | N/A | N/A | N/A |

| 7/6 Year ARM | 0.000 | N/A | N/A | N/A |

| Construction | 0.000 | N/A | N/A | N/A |

FHA Mortgages - 3.5% Down

| Term | Points | Rate (as low as) | Pmt/$10,000 | APR |

|---|---|---|---|---|

| 15 Year | 0.000 | 5.490% | $83.08 | 6.248% |

| 20 Year | 0.000 | 5.990% | $72.84 | 6.836% |

| 25 Year | 0.000 | 5.750% | $64.01 | 6.541% |

| 30 Year | 0.000 | 5.625% | $58.57 | 6.390% |

| 5/6 Year ARM | 0.000 | N/A | N/A | N/A |

Monthly Payment Installment samples shown under rates are based on every $10,000 borrowed. Mortgage Loan Rates & APR are based on $175,000 loan. Rates are subject to change daily. Please contact the credit union for current rates at 815-226-2260.

Recreational Vehicles (Boats, Motor Homes, 5th Wheels, Travel Trailers, Campers)

2026 - 2025

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 25-54 Months | 6.00% | $42.66 - $21.18 |

| 55-78 Months | 6.75% | $21.20 - $15.88 |

| 79-90 Months | 7.00% | $15.84 - $14.32 |

| 91-126 Months / $40,000 Min | 7.50% | $14.45 - $11.50 |

| 127-180 Months / $40,000 Min | 8.00% | $11.71 - $9.57 |

| 181-246 Months / $60,000 Min. | 8.50% | $9.83 - $8.61 |

2024 - 2018

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 25-54 Months | 6.00% | $42.66 - $21.18 |

| 55-78 Months | 6.75% | $21.20 - $15.88 |

| 79-90 Months | 7.25% | $15.96 - $14.45 |

|

91-126 Months / $40,000 Min |

7.75% | $14.58 - $11.63 |

| 127-180 Months / $40,000 Min | 8.25% | $11.84 - $9.71 |

2017 and older

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 25-54 Months | 7.00% | $43.11 - $21.65 |

| 55-78 Months | 7.25% | $21.43 - $16.12 |

| 79-90 Months | 7.50% | $16.09 - $14.57 |

| 91-126 Months / $40,000 Min. | 8.25% | $14.83 - $11.90 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range. Additional terms available.

Savings/Checking Rates

| Accounts | Rate | APY | Minimum Opening Deposit |

|---|---|---|---|

| Savings Account/Business Savings Account | 0.150% | 0.150% | $25 |

| Youth Accounts | 0.150% | 0.150% | $25 |

| Free Basic Checking | 0.00% | 0.00% | No Minimum Deposit Required |

| MyCashback Checking | N/A | N/A | No Minimum Deposit Required |

| HSA Checking | 0.00% | 0.00% | No Minimum Deposit Required |

| Business Checking | 0.00% | 0.00% | No Minimum Deposit Required |

| Christmas Club | 0.150% | 0.150% | No Minimum Deposit Required |

| Vacation Club | 0.150% | 0.150% | No Minimum Deposit Required |

Share (CD) Secured

| Loan Type/Term | Rate |

|---|---|

| Savings Secure Loan with CD Account | 2.00% Over CD Rate |

Student Loans

| Student Loans | ||

|---|---|---|

| Loan Type | Fixed Rate* (as low as) | Variable Rate** (as low as) |

| Undergraduate – Line of Credit | 4.250% | 3.750% |

| Loan Consolidation (5 year) | 5.250% | 4.000% |

| Loan Consolidation (10 year) | 5.750% | 4.750% |

| Loan Consolidation (15 year) | 6.250% | 5.250% |

Floor Rate: 3.00%, Ceiling Rate: 18.00%. *Includes 0.25% discount for auto-pay. ** Adjusts quarterly based on the Prime Rate.

Visa Credit Card

| Card Type | APR for Purchases, Cash Advances and Balance Transfers |

|---|---|

| Visa Platinum Rewards Card | 8.90% to 17.90% |

APR is based on your creditworthiness at the time of account opening.