Give your kids a head start with money smarts.

It is never too early to start saving and learning about money. An Early Smart Saver account for ages 0-4 gives you a dedicated savings account for your child to start them on the path to a bright financial future. As your child grows, so will the financial learning opportunities with our Smart Saver program.

Junior Smart Saver, for ages 5-12, makes saving and learning about money exciting with a free physical passport and fun challenges to earn stamps and cash rewards. Pick up your passport at any location when you open a Junior Smart Saver account or if your Early Smart Saver turns age 5.

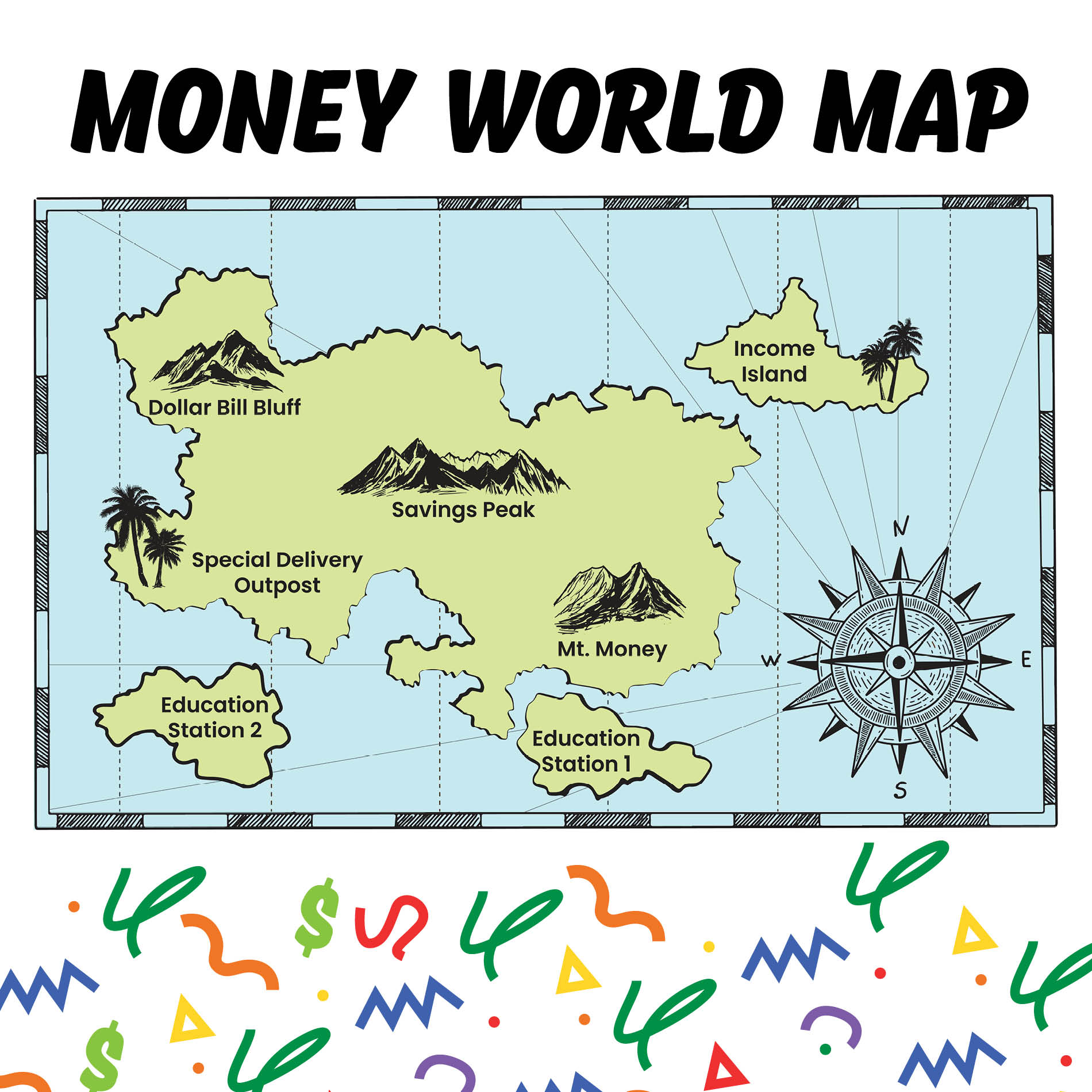

Junior Smart Saver Passport Activities:

- Special Delivery Outpost ($5 reward ): Make sure all your mail goes to the right spot by confirming the email address with your Junior Smart Saver Account.

- Education Station 1 ($5 reward ): Complete the Banzai Junior course.

- Mt. Money ($5 reward ): Save $100 in your Junior Smart Saver Account.

- Dollar Bill Bluff ($10 reward ): Save $500 in your Junior Smart Saver Account.

- Savings Peak ($20 reward ): Save $1,000 in your Junior Smart Saver Account.

- Education Station 2 ($5 reward ): Complete the word search activity found in your Junior Smart Saver Passport.

- Income Island ($5 reward ): Parents complete 3 automatic transfers to the Junior Smart Saver account within 3 months for chores.

For ages 13 and under, parents will need to create a Banzai account for activity progress to be recorded.

Junior Smart Saver Passport Preview

*Incentives earned are paid at the end of the month the incentive was completed. A maximum of one incentive is paid monthly. When more than one incentive is reached within one month, one incentive will be paid the following month, and any additional incentives will be paid at the end of the consecutive months.

Prepare your kids for a healthy financial future by giving them an opportunity to practice banking and money management skills. A Teen Smart Saver can earn cash rewards and digital badges for different activities.

Teen Smart Saver Activities Include:

- Complete Banzai Teen course | $5 reward

- Complete Banzai Plus course | $10 reward

- Enroll In Online Banking | $5 reward

- Enroll In eStatements | $5 reward

- Submit A Mobile Deposit | $5 reward

- Receive Direct Deposit | $5 reward

- Open A Checking Account With Debit Card | $5 reward

- Open A CD Account | $10 reward

- Donation To Impact Fund | MACU matches up to $20 of donation

For ages 13 and under, parents will need to create a Banzai account for activity progress to be recorded.

*Incentives earned are paid at the end of the month the incentive was completed. A maximum of one incentive is paid monthly. When more than one incentive is reached within one month, one incentive will be paid the following month, and any additional incentives will be paid at the end of the consecutive months.

Your child’s membership and money journey at MembersAlliance begins with a joint savings account. From there, you can access financial education, checking accounts with debit cards (for ages 13-17), and our Smart Saver rewards program all at no additional cost to you.

- For ages 0-17

- $25 minimum deposit to open

- No monthly service fee

- Free digital banking

- Free financial education for all ages

- Gives you access to Smart Saver Program (ages 5-17)

- Yearly Smart Saver birthday gift available for pickup (ages 5-17)

Open a savings account that will grow with your child. Once your teen turns 18, the account will automatically transition to an adult membership.

Kids can start practicing real life money management skills with a youth checking account and debit card. When your child turns 18, experience a hassle-free transition to an adult account equipped with all of the skills to succeed.

- For ages 13 – 17

- No minimum deposit

- No minimum balance

- No monthly service fee

- Free digital banking

- Set up balance and purchase text alerts

- Card controls with digital banking

Kids, teens, and adults too can enjoy learning about money made fun with our free online education center Banzai! This center offers gamified learning and simulated financial experiences to make learning about money fun and memorable. Banzai! games are more than just a video and quiz. Kids and teens can explore where different money decisions take them in a fun story format.

Banzai Junior

Have a blast learning to make budgeting decisions and overcome hilarious hurdles as you run your very own lemonade stand.

Banzai Teen

Enjoy a fun spin on making daily money decisions while completing the mission to save enough money for college registration.

Teens can safely build real life credit management & budgeting skills using their own credit card. Easily monitor activity through digital banking and set up alerts to keep track in real time. Have peace of mind knowing your teen's credit score will not be affected while learning how to use this teen credit card. Get your teen off on the right foot with a Teen Xtreme Visa Credit Card!

Card Features

- No annual fee

- No fees on cash advances

- Purchase protection

- Card activity will not affect credit score

To Qualify Teens Must

- Be 16-17 years old

- Hold employment

- Complete Banzai Teen Financial Education Course. Activities included in the course that must be completed include:

- Life Scenarios Activity

- Consumer Smarts Activity

- Banking Activity

- Vocabulary Practice

Other Qualifications

- Parents must qualify as co-signers

Application can be taken at any location. For more information, please contact us directly at 815-226-2260 and ask to speak to a loan officer today.

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Autos, Trucks and Motorcycles

2026 - 2025

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 4.00% | $29.52 |

| 37-78 Months | 5.00% | $29.22 - $15.04 |

| 79-84 Months | 6.00% | $15.35 - $14.61 |

| 85-96 Months / $40,000 Min. | 7.000% | $14.96 - $13.63 |

2024 - 2021

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 5.50% | $30.20 |

| 37-78 Months | 5.50% | $29.45 - $15.28 |

| 79-84 Months | 6.50% | $15.59 - $14.85 |

2020 - 2018

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 5.50% | $30.20 |

| 37-78 Months | 5.50% | $29.45 - $15.28 |

| 79-84 Months | 6.75% | $15.71 - $14.97 |

2017 and older

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 24 Months | 7.50% | $45.00 |

| 25-36 Months | 7.50% | $43.33 - $31.11 |

| 37-48 Months | 7.75% | $30.47 - $24.30 |

| 49-60 Months / $20,000 Min. | 8.50% | $24.23 - $20.52 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

Computer and Other Durable Goods

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 24 Months | 7.00% | $44.79 |

| 36 Months | 8.00% | $31.35 |

| 48 Months | 9.00% | $24.90 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

FastCash Loan

| Loan Type/Term | Rate (as low as) | Pmt/$1,000 |

|---|---|---|

| Up to 12 Months | 9.50% | $87.68 |

| 13-24 Months | 9.75% | $81.37 - $46.03 |

| 25-36 Months | 10.00% | $44.48 - $32.27 |

| 37-48 Months | 10.50% | $31.75 - $25.61 |

| 49-60 Months | 11.25% | $25.55 - $21.87 |

| Signature Line of Credit | 10.90% | 3% of Limit |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit). Not available on Unsecured Line of Credit Loans.

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

Home Equity - Fixed Rate - Up to 80% Loan to Value

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| Up to 60 Months | 6.00% | $44.32 - $19.34 |

| 61-120 Months | 6.75% | $19.42 - $11.49 |

| 121-180 Months | 7.25% | $11.68 - $9.14 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Monthly Payment Installment samples shown are based on every $1,000 borrowed. Rates may vary based on credit evaluation. Rates subject to change without notice. Closing costs may vary if out of the Rockford area, an appraisal is required, or a release of mortgage is recorded.

Home Equity Line of Credit - Adjustable Rate - Up to 80% Loan to Value

Rate discounted at 6.625% for the first year. Adjusts to the Wall Street Journal Prime Rate annually, which is currently at 6.750% Maximum APR = 18% Annual Fee = $10.00

Monthly Payment Installment samples shown are based on every $1,000 borrowed. Rates may vary based on credit evaluation. Rates subject to change without notice. Closing costs may vary if out of the Rockford area, an appraisal is required, or a release of mortgage is recorded.

IRA/CD Rates

| Type/Term | Minimum Opening Deposit | Rate | APY | Penalty for Early Withdrawal |

|---|---|---|---|---|

| Base IRA (Primary, Education, Roth) | $500 | 0.150% | 0.150% | N/A |

| 3 Month CD* | $500 | 0.995% | 1.000% | 90 Days* |

| 6 Month CD/IRA CD** | $500 | 1.980% | 2.000% | 90 Days |

| 9 Month CD/IRA CD | $500 | 2.250% | 2.275% | 90 Days |

| 12 Month CD/IRA CD | $500 | 2.956% | 3.000% | 180 Days |

| 18 Month CD/IRA CD | $500 | 2.956% | 3.000% | 180 Days |

| 24 Month CD/IRA CD | $500 | 2.762% | 2.800% | 180 Days |

| 30 Month CD/IRA CD | $500 | 2.762% | 2.800% | 180 Days |

| 36 Month CD/IRA CD | $500 | 2.762% | 2.800% | 180 Days |

| 48 Month CD/IRA CD | $500 | 1.980% | 2.000% | 365 Days |

| 60 Month CD/IRA CD | $500 | 1.980% | 2.000% | 365 Days |

Minimum Deposit = $500.00. A penalty will or may be imposed for early withdrawals. *3 month CD not eligible for IRAs.** 6 month CD not eligible for Roth and Education IRAs.

Money Market Accounts

| Balance | Rate | APY |

|---|---|---|

| $2,500 - $9,999.99 | 0.946% | 0.950% |

| $10,000 - $24,999.99 | 1.094% | 1.100% |

| $25,000 - $99,999.99 | 1.341% | 1.350% |

| $100,000+ | 1.587% | 1.600% |

Off Road RVs, Snowmobiles and Jet Skis

2026 - 2025

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 4.50% | $29.75 |

| 37-48 Months | 6.25% | $29.78 - $15.63 |

| 49-80 Months | 6.75% | $15.71 - $14.97 |

| 61-78 Months / $20,000 Min. | 7.25% | $15,08 - $13.76 |

2024 - 2018

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| up to 36 Months | 5.50% | $30.20 |

| 37 -48 Months | 6.50% | $29.90- $15.75 |

| 49-60 Months | 7.50% | $16.08 - $15.34 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

Personal Loans (Unsecured)

| Loan Type/Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| Up to 12 Months | 9.50% | $87.68 |

| 13-24 Months | 9.75% | $81.37 - $46.03 |

| 25-36 Months | 10.00% | $44.48 - $32.27 |

| 37-48 Months | 10.50% | $31.75 - $25.61 |

| 49-60 Months | 11.25% | $25.55 - $21.87 |

| Signature Line of Credit | 10.90% | 3% of Limit |

| FastCash* | 23.00% | $177.96 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit). Not available on Unsecured Line of Credit Loans.

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range.

*FastCash Application fee of $20 required, regardless of approval decision. FastCash loan is a fixed rate of 23%APR on loan amounts from $200 to $1,000 with terms not to exceed 6 months. Financing example: The monthly installment repayment for $1,000 financed for 6 months at 23.00% is $177.96. No credit check. MACU membership must be at least 90 days old and have an existing direct deposit with the credit union. Only one FastCash loan per household. Some restrictions may apply.

Primary Mortgage

Conventional Mortgages - 5% Down

| Term | Points | Rate (as low as) | Pmt/$10,000 | APR |

|---|---|---|---|---|

| 15 Year Fixed Rate | 0.000 | 4.990% | $79.03 | 5.215% |

| 15 Year Fixed Rate | 1.000 | 4.500% | $76.50 | 4.862% |

| 20 Year Fixed Rate | 0.000 | 5.625% | $69.50 | 5.988% |

| 20 Year Fixed Rate | 1.000 | 5.375% | $68.08 | 5.695% |

| 30 Year Fixed Rate | 0.000 | 5.750% | $58.36 | 6.129% |

| 30 Year Fixed Rate | 1.000 | 5.500% | $56.78 | 5.948% |

| 5/6 Year ARM | 0.000 | N/A | N/A | N/A |

| 7/6 Year ARM | 0.000 | N/A | N/A | N/A |

| Construction | 0.000 | N/A | N/A | N/A |

FHA Mortgages - 3.5% Down

| Term | Points | Rate (as low as) | Pmt/$10,000 | APR |

|---|---|---|---|---|

| 15 Year | 0.000 | 5.490% | $83.08 | 6.248% |

| 20 Year | 0.000 | 5.990% | $72.84 | 6.836% |

| 25 Year | 0.000 | 5.750% | $64.01 | 6.541% |

| 30 Year | 0.000 | 5.625% | $58.57 | 6.390% |

| 5/6 Year ARM | 0.000 | N/A | N/A | N/A |

Monthly Payment Installment samples shown under rates are based on every $10,000 borrowed. Mortgage Loan Rates & APR are based on $175,000 loan. Rates are subject to change daily. Please contact the credit union for current rates at 815-226-2260.

Recreational Vehicles (Boats, Motor Homes, 5th Wheels, Travel Trailers, Campers)

2026 - 2025

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 25-54 Months | 6.00% | $42.66 - $21.18 |

| 55-78 Months | 6.75% | $21.20 - $15.88 |

| 79-90 Months | 7.00% | $15.84 - $14.32 |

| 91-126 Months / $40,000 Min | 7.50% | $14.45 - $11.50 |

| 127-180 Months / $40,000 Min | 8.00% | $11.71 - $9.57 |

| 181-246 Months / $60,000 Min. | 8.50% | $9.83 - $8.61 |

2024 - 2018

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 25-54 Months | 6.00% | $42.66 - $21.18 |

| 55-78 Months | 6.75% | $21.20 - $15.88 |

| 79-90 Months | 7.25% | $15.96 - $14.45 |

|

91-126 Months / $40,000 Min |

7.75% | $14.58 - $11.63 |

| 127-180 Months / $40,000 Min | 8.25% | $11.84 - $9.71 |

2017 and older

| Term | APR (as low as) | Pmt/$1,000 |

|---|---|---|

| 25-54 Months | 7.00% | $43.11 - $21.65 |

| 55-78 Months | 7.25% | $21.43 - $16.12 |

| 79-90 Months | 7.50% | $16.09 - $14.57 |

| 91-126 Months / $40,000 Min. | 8.25% | $14.83 - $11.90 |

Rates disclosed are As Low As Rates, which are based on the A+ credit discount (credit score >740) and Multiple Service discount (active checking account with direct deposit).

Loan rates may vary based on credit evaluation. Monthly Payment Installment samples shown are based on every $1,000 borrowed and the minimum term and maximum term within each term range. Additional terms available.

Savings/Checking Rates

| Accounts | Rate | APY | Minimum Opening Deposit |

|---|---|---|---|

| Savings Account/Business Savings Account | 0.150% | 0.150% | $25 |

| Youth Accounts | 0.150% | 0.150% | $25 |

| Free Basic Checking | 0.00% | 0.00% | No Minimum Deposit Required |

| MyCashback Checking | N/A | N/A | No Minimum Deposit Required |

| HSA Checking | 0.00% | 0.00% | No Minimum Deposit Required |

| Business Checking | 0.00% | 0.00% | No Minimum Deposit Required |

| Christmas Club | 0.150% | 0.150% | No Minimum Deposit Required |

| Vacation Club | 0.150% | 0.150% | No Minimum Deposit Required |

Share (CD) Secured

| Loan Type/Term | Rate |

|---|---|

| Savings Secure Loan with CD Account | 2.00% Over CD Rate |

Student Loans

| Student Loans | ||

|---|---|---|

| Loan Type | Fixed Rate* (as low as) | Variable Rate** (as low as) |

| Undergraduate – Line of Credit | 4.250% | 3.750% |

| Loan Consolidation (5 year) | 5.250% | 4.000% |

| Loan Consolidation (10 year) | 5.750% | 4.750% |

| Loan Consolidation (15 year) | 6.250% | 5.250% |

Floor Rate: 3.00%, Ceiling Rate: 18.00%. *Includes 0.25% discount for auto-pay. ** Adjusts quarterly based on the Prime Rate.

Visa Credit Card

| Card Type | APR for Purchases, Cash Advances and Balance Transfers |

|---|---|

| Visa Platinum Rewards Card | 8.90% to 17.90% |

APR is based on your creditworthiness at the time of account opening.